Advisory

The Recovery Loan Scheme vs. Alt-Fi products

7 Apr 2021

The Recovery Loan Scheme (RLS) launched on 6 April 2021. Designed as a follow-up to the CBILS, CLBILS and BBLS, which all closed on 31 March, it provides businesses with access to the finance they need during the nation’s post-lockdown period of recovery.

It's important for your clients to know that the RLS isn’t the only option. Whether they need a speedy working capital boost or longer-term funding to facilitate growth, there are a range of alternative finance solutions out there that could in fact have more “favourable” terms.

“...a key aim of the Recovery Loan Scheme is to improve the terms on offer to you, but if a lender can offer you the choice of a commercial loan on better terms, without requiring the guarantee provided by the RLS, they should do so.”

– British Business Bank

But, how does the Recovery Loan Scheme compare with the other alt-fi products out there?

Before we explore some of the alternative finance options that could benefit your clients as they reopen and recover, let’s see how the scheme differs from one of its main predecessors: the Coronavirus Business Interruption Loan Scheme (CBILS).

RLS vs CBILS – how do they compare?

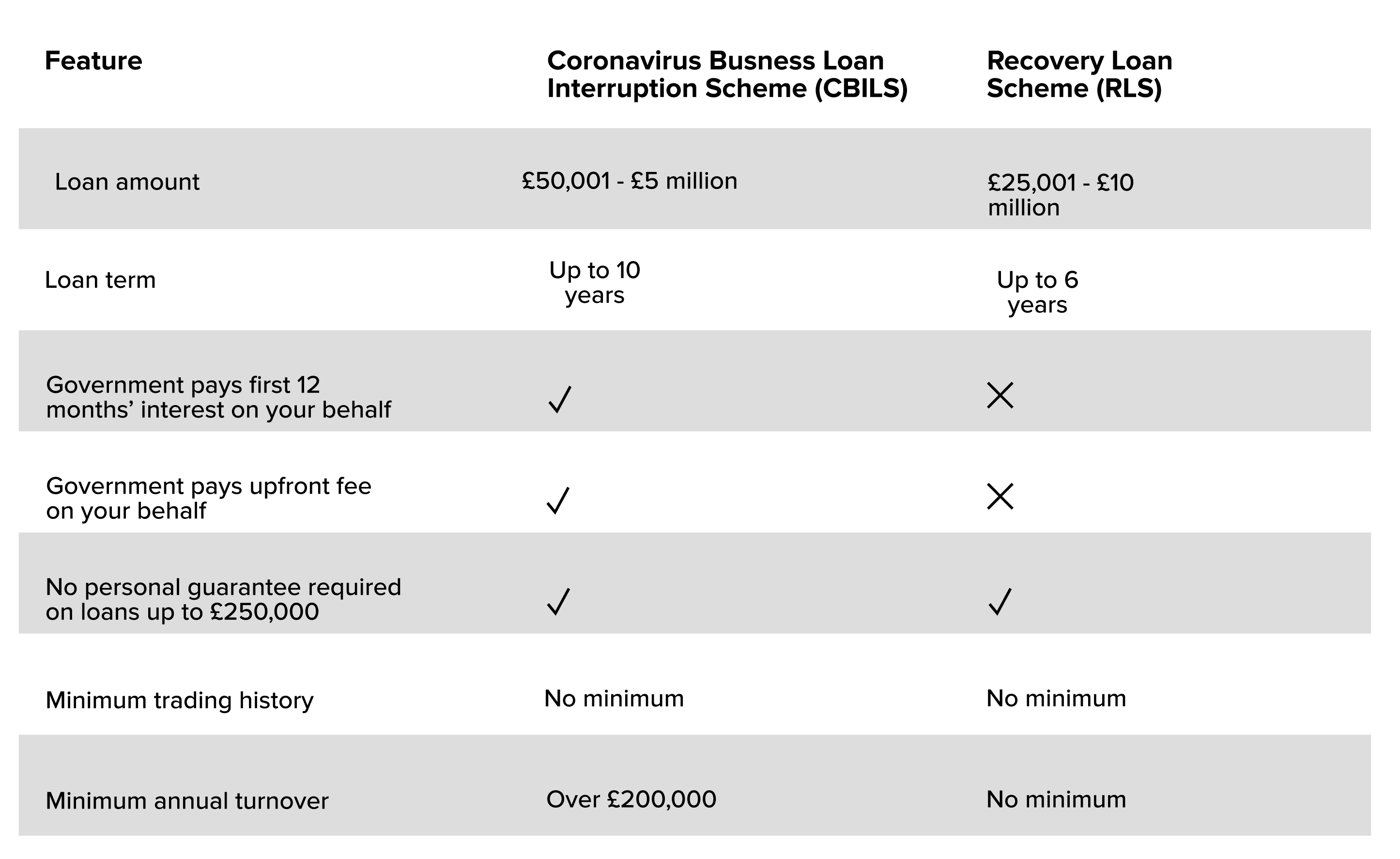

As the table below shows, there are some similarities between the two schemes. For instance, your client won’t have to give a personal guarantee if they apply for finance under £250,000. On the other hand, they must cover all interest payments (the Government covered the initial 12 months for the CBILS).

CBILS vs. RLS Comparison Table

It’s worth noting that the RLS is more accessible than the CBILS in that no minimum turnover is required. It’s open to startups with a small turnover and larger established businesses alike. Finance of up to £10 million is available.

Recovery Loan Scheme: key pointers

Term length: Term loans and asset finance facilities are available for up to six years; overdrafts and invoice finance are available for up to three years.

Value: The maximum value of each type of facility is £10m (£30m per group). Minimum facility sizes start at £1,000 for asset and invoice finance, and £25,001 for term loans and overdrafts.

Accessibility: No minimum/maximum trading history or annual turnover is required.

Personal guarantees: No personal guarantees on loan amounts under £250,000.

Liability: Businesses remain 100% liable for the debt and must meet all interest payments and fees associated with their RLS facility.

CBILS borrowers: The RLS is open to those who’ve borrowed from any of the previous schemes. However, the amount they borrowed under another scheme might affect how much they’re eligible for.

Which lenders are delivering finance through the RLS?

Various lenders are currently offering RLS finance, including both high street banks and alternative lenders. Only lenders accredited by the British Business Bank are permitted to deliver the scheme. The scheme gives lenders a government-backed guarantee against the outstanding balance of the facility, providing them with more confidence to lend.

Other Alt-Fi types for your clients to explore

Aside from the RLS, there are many other types of finance products out there for your clients to take advantage of. Business owners can apply for term loans, overdraft, asset finance and invoice finance facilities that aren’t part of the RLS, as well as other types of finance such as merchant cash advances, revolving credit facilities and eCommerce facilities.

Revolving Credit Facility

A revolving credit facility lets businesses access funds on a “tap in, tap out” basis. They can take advantage of their available funds as and when they need to and will only get charged interest when the facility is used. The highly flexible nature of this product can make it worth consideration for SMEs in need of a speedy cash injection.

Asset Finance

Some of your clients may find themselves in a position where they are reopening, whereby they require an additional piece of equipment or machinery to meet demand. Others may be ramping up their delivery services and need a new vehicle, for instance.

Asset finance allows business owners to spread the cost of their new purchase over a longer period, making the process more affordable. Depending on the type of asset finance, the borrower can buy it outright at the end of the term or upgrade to a newer model.

Invoice finance

Your clients can borrow money based on what their own clients owe them (via their debtor book) using invoice finance. It means that instead of waiting to get paid, they can receive a percentage of the money quickly through a lender.

eCommerce finance

There’s a variety of finance options out there for growing eCommerce companies, including fast business loans and working capital finance. Trade finance is also available for those who import goods from abroad.

Merchant cash advance

Many businesses that are re-opening on 12 April and 17 May will be looking for flexible finance as they re-establish their presence following the lockdown. Designed for companies that take customer card payments, merchant cash advances enable business owners to borrow a sum and pay it back through a percentage of their customers’ transactions.

Early repayment business loans

Short-term loans can help businesses cover operational outgoings or costs associated with growth until they can pay off the finance or refinance the debt. Because the approval process is quick, early-repayment loans can appeal to SMEs in need of fast finance options.

Join Connect to help your clients access finance

At Funding Options, we processed over £760M in CBILS and continue to help SMEs access alternative finance from a range of over 120+ reputable lenders. By combining our market expertise with innovative technology, we’re able to search the market to find the right funding options for businesses operating in any sector.

Join our advisory platform, Connect, to ensure your clients can access the finance they need in order to continue to trade and grow with confidence throughout the recovery period.

We offer an instant comparison and help throughout the process, from application to when your client receives the funds. To get started, SME owners will be asked to provide some basic details, including how much they need to borrow and how quickly they need funding.

Find out more about how we can support your clients' need for alternative finance here.

Subscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.